- BUY TURBOTAX 2016 PREMIER INSTALL

- BUY TURBOTAX 2016 PREMIER UPDATE

- BUY TURBOTAX 2016 PREMIER FULL

- BUY TURBOTAX 2016 PREMIER SOFTWARE

- BUY TURBOTAX 2016 PREMIER PC

The CRA typically estimates 8-14 days for electronic transmissions with direct deposit.

BUY TURBOTAX 2016 PREMIER SOFTWARE

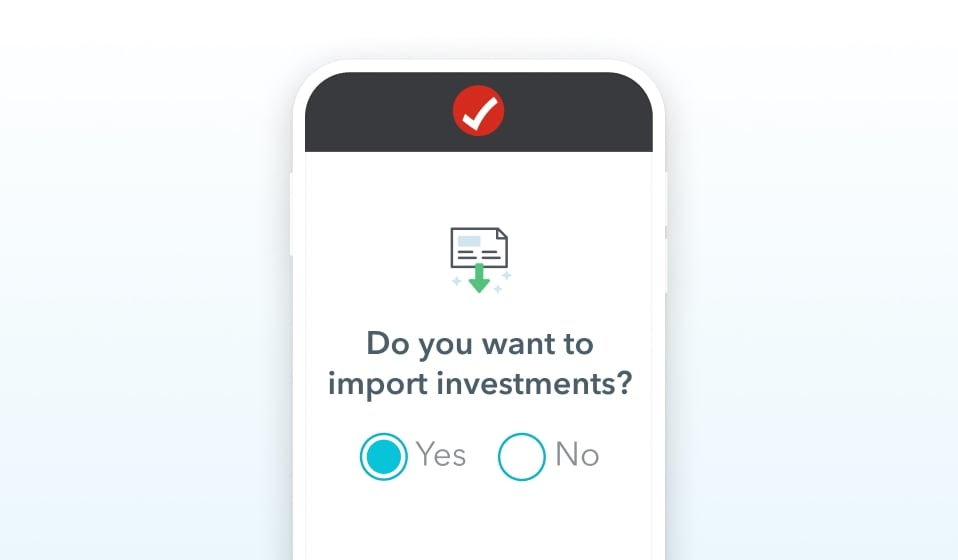

All TurboTax software products for tax year 2021 are CRA NETFILE certified. Income tax preparation software companies must seek NETFILE certification from the Canada Revenue Agency (the “CRA”) for tax preparation software products to be used in conjunction with CRA’s NETFILE electronic tax filing service.Must be signed up for CRA's My Account service to import into TurboTax.CRA estimates 8-14 days for electronic NETFILE submissions with direct deposit.All prices are subject to change without notice.) (Prices are determined at the time of print or electronic filing. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Satisfaction guaranteed or you don't pay.This guarantee cannot be combined with the TurboTax Satisfaction (Easy) Guarantee. Audit Defence and fee-based support services are excluded. Claims must be submitted within sixty (60) days of your TurboTax filing date, no later than (TurboTax Home & Business and TurboTax 20 Returns no later than July 15, 2022). TurboTax Free customers are entitled to a payment of $9.99. If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software.This guarantee does not apply to TurboTax Free.

BUY TURBOTAX 2016 PREMIER PC

Many of us are getting frustrated especially when we are first-time consumers of turbotax premier 2016 tax software federal state fed efile pc mac disc.

BUY TURBOTAX 2016 PREMIER FULL

BUY TURBOTAX 2016 PREMIER UPDATE

The IRS will bill you for this it will not be calculated by TurboTax. If you owe taxes, the interest/penalties will be calculated by the IRS based on how much you owe and when they receive your return and payment. If you are getting a refund, there is not a penalty for filing past the deadline. Important! Mail Federal and State in separate envelopes and mail each year in separate envelopes. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS received the return. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. You have to print and mail prior year returns.

BUY TURBOTAX 2016 PREMIER INSTALL

You need a full Windows or Mac computer to install it on. You have to buy a separate program for each year. You can only buy the download for prior years.

0 kommentar(er)

0 kommentar(er)